Direction: Read the following information carefully and answer the questions based on it.

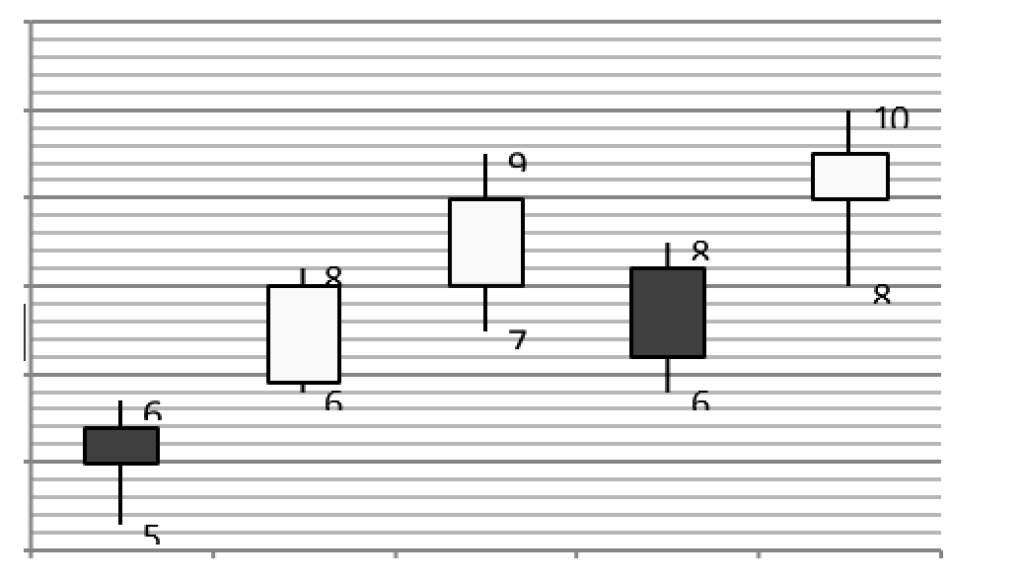

The following chart shows the price of shares of company A on five trading days during an active trading session. The ceiling and floor of the line depicts the maximum and minimum prices respectively of a share throughout the day. The ceiling and floor of the box depicts opening price and closing price respectively for black box and the opposite in case of white box.

There are some other charges on buying and selling as per:

• Brokerage Charge on buying- 0.60%(max Rs 50) uptoRs 10000, 0.30% (max Rs 125) above Rs 10000 and uptoRs 50000 and 0.15%(max Rs 500) above Rs 50000.

• Brokerage Charge on selling- 0.80% (max Rs 300) uptoRs 50000 and 0.60% (max Rs 2000) above Rs 50000.

• Stamp Duty- .015% flat on buying only

• Securities Transaction Tax(STT)- 0.1% flat on both side

GST @18% is levied extra on brokerage charges for each transactions

1) Prakash bought 50000 shares of company A at Rs 2 more than that day’s low on 30-04-2019 and sold them on 03.05.2019 at Rs 3 less than that day’s high. What is the profit or loss percentage of Prakash on the selling of shares?

A. 66.80%

B. 67.30%

C. 64.50%

D. 61.21%

E. None of these

Sol:

Day’s low on 30thapril=Rs 53

=> Buying price of Prakash=53+2= Rs 55

Cost price of 50000 shares=55*50000=Rs

2750000

Brokerage cost is 0.15% or Rs 500 whichever is

lower for the corresponding slab.

Brokerage cost at 0.15%=0.15/100*2750000=

Rs 4125

So actual brokerage cost=Rs 500. With

GST @18%, brokerage cost=1.18*500=Rs

590

Stamp duty=0.015% and STT=0.1%

Total overhead cost=Rs

590+0.115%*2750000=Rs 590+ Rs 3162.50=Rs

3752.50

Total CP for Prakash with overhead

cost=2750000+3752.50=Rs 2753752.50

Day’s high on 3rd May, 2021=Rs 95

=> Selling price of Prakash=Rs 92

Money from selling 50000 shares=92*50000=Rs

4600000

Brokerage on selling is @0.60% or Rs 2000

whichever is lower.

Brokerage @0.60%=0.60/100*4600000= Rs

27600. Thus, brokerage cost would be Rs

2000

STT on selling=0.1/100*4600000= Rs 4600

Total money with Prakash after deduction of

brokerage and STT=Rs 4600000-Rs 4600-

Rs 2000=Rs 4593400

So, Prakash shall be in profit. Total profit= Rs

4593400-Rs 2753752.50=Rs 1839647.50

Profit percentage =1839647.50/2753752.50*100

=66.80 %

2) Someone bought 200 shares on 30th April, 100 shares on 2nd May and 250 shares on 4th May at the opening price. What is the average cost per share considering all the charges?

A. Rs 73.09

B. Rs 73.43

C. Rs 74.15

D. Rs 72.85

E. None of these

Sol:

Buying price=Rs 64. Total cost of buying=Rs

64*200=Rs 12800. Brokerage cost

@0.30%=0.30/100*12800=Rs 38.40

STT=0.1/100*12800=Rs 12.8

Stamp Duty=0.015/100*12800=Rs 1.92

Total cost including overhead

costs=Rs.12800+Rs.38.40+Rs.12.8+Rs.1.9

2=Rs 12853.12

On 2nd May,

Buying Price=Rs 69. Total cost of buying=Rs

69*100=Rs 6900

Brokerage cost @0.60%=Rs 41.4

STT and Stamp duty=0.115*6900=Rs 7.935

Total cost including overhead

costs=Rs.6900+Rs.41.4+Rs.7.935=Rs.6949.335

On 4th May,

Buying Price=Rs 82. Total cost of buying= Rs

82*250=Rs 20500

Brokerage cost at 0.30% =0.30/100*20500=Rs

61.50

STT and Stamp

duty=0.115/100*20500=Rs.23.575

Total cost including overhead costs

=Rs.20500+Rs.61.50+Rs.23.575 =Rs.20585.075

Total cost of all

shares=Rs.12853.12+Rs.6949.335+Rs.20585.0

75=Rs 40387.53

Total shares owned=200+100+250=550

=> Average price per share=40387.53/550=Rs

73.43

3) What is the 5-day simple moving average of the share on the basis of the average of opening and closing price on these five days?

A. 85.8

B. 78.2

C. 79.4

D. 74.5

E. None of these

On the basis of average of opening and closing

price of the share,

Price on 30.04.2019= (64+60)/2=62

Price on 02.05.2019= (69+80)/2=74.5

Price on 03.05.2019= (80+90)/2=85

Price on 04.05.2019= (82+72)/2=77

Price on 05.05.2019= (90+95)/2=92.5

=> Simple moving average of the share =

(62+74.5+85+77+92.5)/5 =391/5 =78.2

4) Aakash bought 2000 shares on

02.05.2019 and sold them on 04.05.2019 both at opening price. If Aakash plans to buy the shares again on 05.05.2019 at day’s low, how many shares he could buy with the profit he gets by selling shares on 04.05.2019?

A.302

B. 303

C. 300

D. 301

E. 212

Sol:

On 02.05.2019, opening price=Rs 69

Cost of 2000 shares=2000*69=Rs 1,38,000

Brokerage @0.15%=Rs 207

STT+Stamp duty@ (0.1+0.015) i.e.,

@0.115%=Rs 158.70

Total cost price for Aakash=Rs 1,38,365.70

On 04.05.2019, opening price=Rs 82

Money from sale of 2000 shares=Rs 164000

Brokerage @0.60%=Rs 984

STT @0.1% =Rs 164

Total money from sales of shares=Rs 164000-

Rs 984- Rs 164=Rs 162852

Thus, profit of Aakash=Rs 162852-Rs

138365.70=Rs 24322.30

Now, day’s low on 05.05.2019=Rs 80

If Aakash buys 303 shares, cost=303*80=Rs

24240

Brokerage@0.30%=Rs 72.72

STT+Stamp Duty @0.115%=Rs 27.876

Total cost=Rs 24240+Rs 72.72+Rs 27.876=

Rs 24340.596 which is higher than profit Rs

24322.30

So Aakash must buy 302 shares.

5) Some shares were bought on 2nd May at the opening price and were sold on day’s high on the same day. How many shares must be traded on an intraday basis to get a profit of a minimum of Rs.5000?

A. 385

B. 398

C. 391

D. Can’t be determined

E. None of these

Sol:

On 2nd may

Opening price =Rs 69

Day’s high=Rs 82

Excluding taxes and brokerage, profit in one

share=Rs 13

For 385 shares,

Buying cost=Rs 69*385=Rs 26565

Brokerage @0.30 %( as total buying is

between Rs 10000 and Rs 50000)

=0.30/100*385*69=Rs 79.695

STT & STAMP

DUTY@0.115%=0.115/100*26565=Rs 30.55

Selling cost=Rs 82*385=Rs 31570

Brokerage@0.80 %=Rs 252.56

STT @0.1%=Rs 31.57

Net profit=31570-26565-79.695-30.55-

252.56-31.57= Rs 4610.625 which is

short of target Rs 5000 by Rs 389.375.

For 398 shares,

Buying cost=Rs 69*398=Rs 27462

Brokerage @0.30 %( as total buying is

between Rs 10000 and Rs 50000) =Rs

82.386

STT & STAMP DUTY@0.115%=Rs 31.58

Selling cost=Rs 82*398=Rs 32636

Brokerage@0.80 %=Rs 261

STT @0.1%=Rs 32.64

Net profit=32636-27462-82.386-31.58-261-

32.64=Rs 4766.39 which is again less than

Rs 5000

Since 398 shares don’t fulfil the profit

requirement, 391 shares will also not fulfil the

requirement.

Thus, none of the option gives Rs 5000 profit.