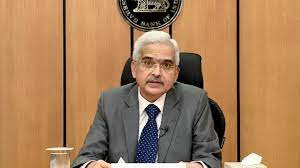

RBI Governor Shaktikanta Das-headed rate-setting panel MPC kept the key lending rates unchanged amid a sudden surge in COVID-19 cases across the country. It has decided to keep its short term lending rate or the repo rate unchanged at 4 per cent, in line with market expectations.

Daily Current Affairs Quiz 2021

Announcing the monetary policy, RBI Governor said the central bank will maintain its ‘accommodative stance’ as long as required to sustain growth on a durable basis.

The RBI maintained its GDP growth forecast at 10.5 per cent for 2021-22.

RBI also announced a series of measures to inject liquidity in the government securities market and the financial system.

RBI will ensure orderly conduct of government borrowing programme. In this respect, the central bank announced a secondary market government securities (G-sec) acquisition plan worth Rs 1 lakh crore for April-June.

Amid the government plans to support a new asset reconstruction company being set up by banks, the RBI has decided to set up a committee to review the working of ARCs to ensure how better these entities can support the financial sector.

In the policy review, the RBI decided to extend the RTGS and NEFT payments platforms to prepaid payment instruments, white label ATMs as well.