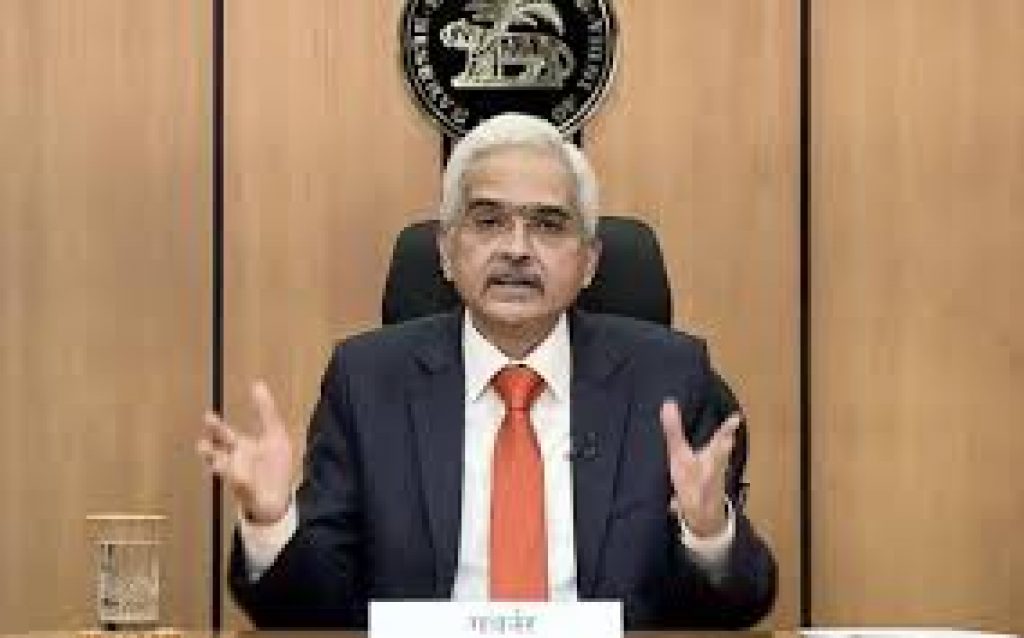

RBI unveils measures for MSMEs to deal with COVID-19 crisis

The Reserve Bank of India (RBI) announced several measures to protect small and medium businesses, individual borrowers from the adverse impact of the intense second wave of COVID-19 across the country.

Daily Current Affairs Quiz 2021

Individuals, borrowers and MSMEs with aggregate exposure up to Rs. 25 crore, who have not availed restructuring under any previous frameworks, who were classified as standard on 31 March, 2021, will be eligible to be considered under Resolution Framework 2.0.

Restructuring under new framework can be invoked till September 30, 2021 and will have to be implemented within 90 days after invocation.

For individuals and small businesses who have availed restructuring of loans under Resolution Framework 1.0, where moratorium of less than 2 years was permitted, lending institutions can now increase the period and/or extend residual tenure up to a total period of 2 years.

In respect of small businesses and MSMEs restructured earlier, lending institutions are now permitted to review working capital sanction limits, as a one-time measure.